American Funds Portfolio Series Brochure

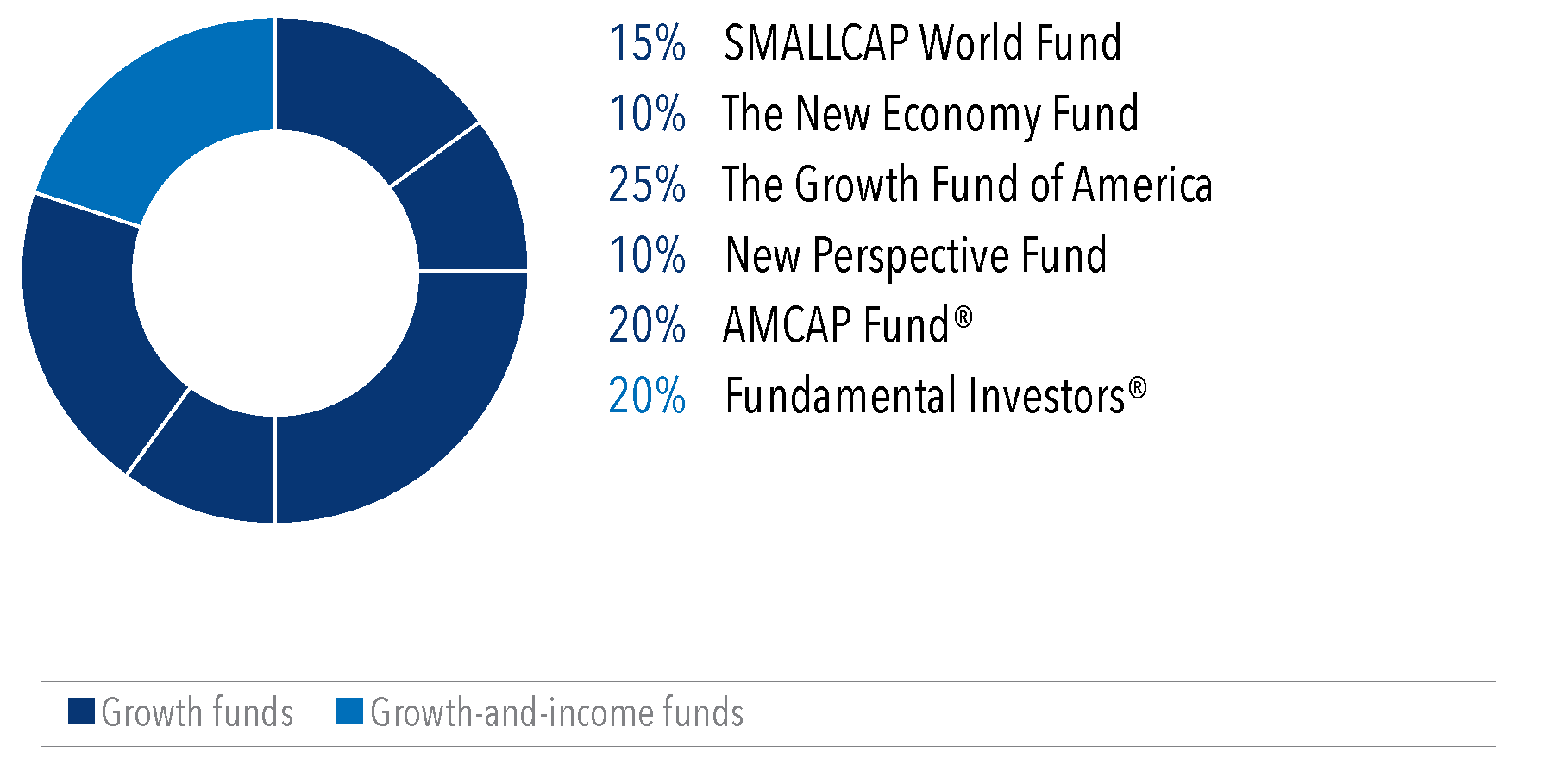

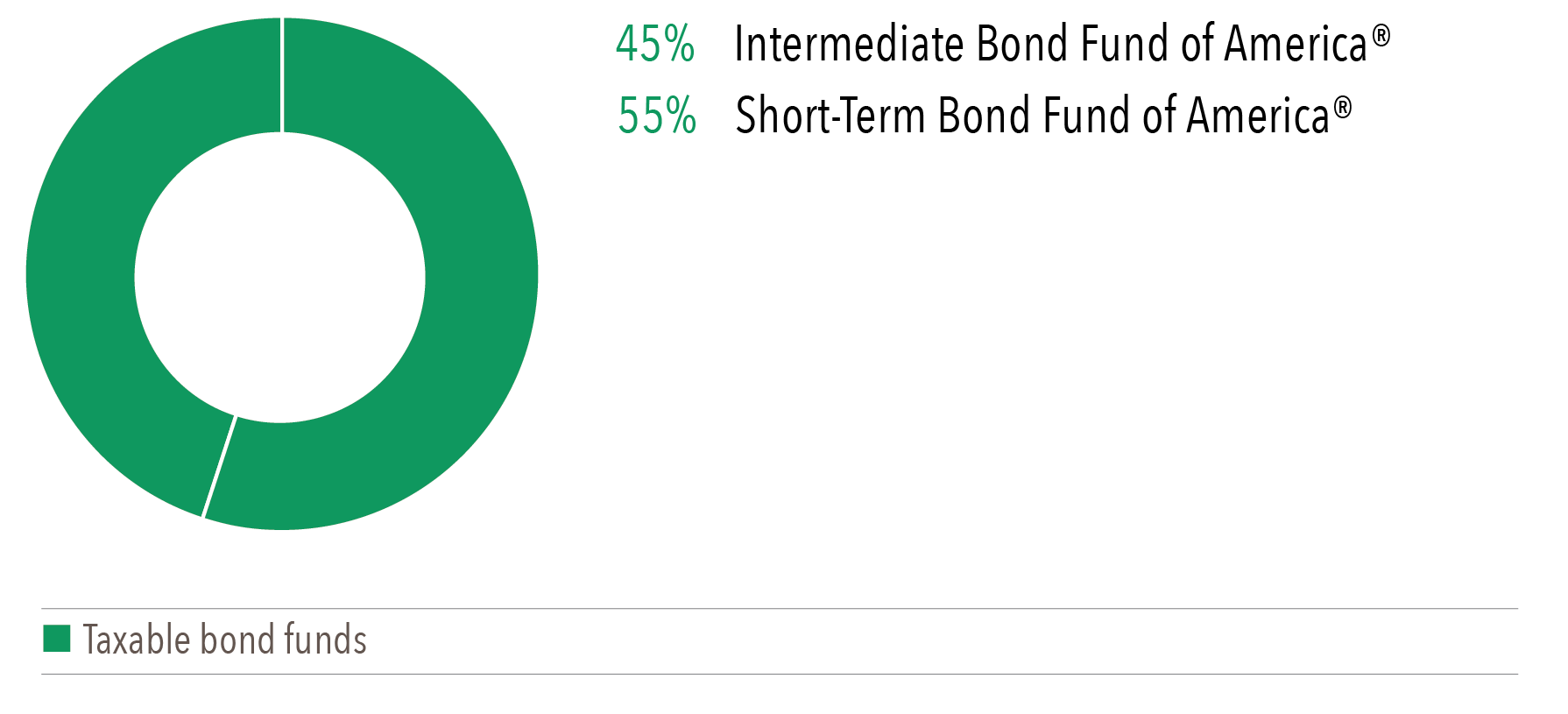

American Funds Portfolio Series Brochure - In this brochure, we’ll examine the unique combination of strengths that makes american funds different. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. Each portfolio series fund represents a blend of individual american funds, all with a proven track record and investment management process. In particular, we’ll take a detailed look at five factors that, over time, have benefited. An oversight committee meets regularly to. The american funds retirement income portfolio series consists of three managed portfolios — conservative, moderate and enhanced — that can help retirees address their income and. For example you may have seen american funds growth fund of america or american funds fundamental investors or american funds small cap world in either r1, r2,. Each underlying american funds fund is managed by a group of portfolio managers. The american funds portfolio series is designed to help investors pursue long‐term investment success. The american funds portfolio series is designed to help. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. In this brochure, we’ll examine the unique combination of strengths that makes american funds different. The american funds retirement income portfolio series consists of three managed portfolios — conservative, moderate and enhanced — that can help retirees address their income and. For example you may have seen american funds growth fund of america or american funds fundamental investors or american funds small cap world in either r1, r2,. Team managementpractice management ideasclient acquisitionpathways to growth Seven portfolios of mutual funds are designed for a variety of investor objectives and risk profiles. Each underlying american funds fund is managed by a group of portfolio managers. The american funds portfolio series is designed to help investors pursue long‐term investment success. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. Consider what these funds offer: The portfolios spread risk over multiple, diverse types and classes of mutual funds. In this brochure, we’ll examine the unique combination of strengths that makes american funds different. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. For example you may have seen american. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. Purchase a diversified portfolio of. Consider what these funds offer:. The portfolios spread risk over multiple, diverse types and classes of mutual funds. Each portfolio series fund represents a blend of individual american funds, all with a proven track record and investment management process. Consider what these funds offer: Each underlying american funds fund is managed by a group of portfolio managers. You can find the portfolio’s prospectus and other. In particular, we’ll take a detailed look at five factors that, over time, have benefited. The american funds retirement income portfolio series consists of three managed portfolios — conservative, moderate and enhanced — that can help retirees address their income and. Team managementpractice management ideasclient acquisitionpathways to growth Describes all of american funds' managed portfolios offerings, including portfolio series and. Team managementpractice management ideasclient acquisitionpathways to growth Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. Diversification does not ensure a profit or protect against loss in declining markets. Each underlying american funds fund is managed by a group of portfolio managers. Describes all. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. Seven portfolios of mutual funds are designed for a variety of investor objectives and risk profiles. The american funds retirement income portfolio series consists of three managed portfolios — conservative, moderate and enhanced — that. In particular, we’ll take a detailed look at five factors that, over time, have benefited. An oversight committee meets regularly to. For example you may have seen american funds growth fund of america or american funds fundamental investors or american funds small cap world in either r1, r2,. Describes all of american funds' managed portfolios offerings, including portfolio series and. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. The portfolios spread risk over multiple, diverse types and classes of mutual funds. You can find the portfolio’s prospectus and other information about the portfolio (including the documents listed below) online at www.metlife.com/variablefunds. The american. The american funds portfolio series is designed to help. Consider what these funds offer: For example you may have seen american funds growth fund of america or american funds fundamental investors or american funds small cap world in either r1, r2,. You can find the portfolio’s prospectus and other information about the portfolio (including the documents listed below) online at. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. The portfolios spread risk over multiple, diverse types and classes of mutual funds. Team managementpractice management ideasclient acquisitionpathways to growth Seven portfolios of mutual funds are designed for a variety of investor objectives and risk. Purchase a diversified portfolio of. You can find the portfolio’s prospectus and other information about the portfolio (including the documents listed below) online at www.metlife.com/variablefunds. Diversification does not ensure a profit or protect against loss in declining markets. In this brochure, we’ll examine the unique combination of strengths that makes american funds different. Consider what these funds offer: Team managementpractice management ideasclient acquisitionpathways to growth The american funds retirement income portfolio series consists of three managed portfolios — conservative, moderate and enhanced — that can help retirees address their income and. Seven portfolios of mutual funds are designed for a variety of investor objectives and risk profiles. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. In particular, we’ll take a detailed look at five factors that, over time, have benefited. The american funds portfolio series is designed to help. The american funds portfolio series is designed to help investors pursue long‐term investment success. Each portfolio series fund represents a blend of individual american funds, all with a proven track record and investment management process.Capital Group / American Funds on Behance

American Funds Portfolio Series Capital Group

American Funds Portfolio Series Capital Group

CapitalGroup American Funds Brochure — Johnson Fung

American Funds, Vanguard, Fidelity mutual funds and ETFs among the

Liberty Fund Brochure

CapitalGroup American Funds Brochure — Johnson Fung

American Funds College Target Date Series American Funds

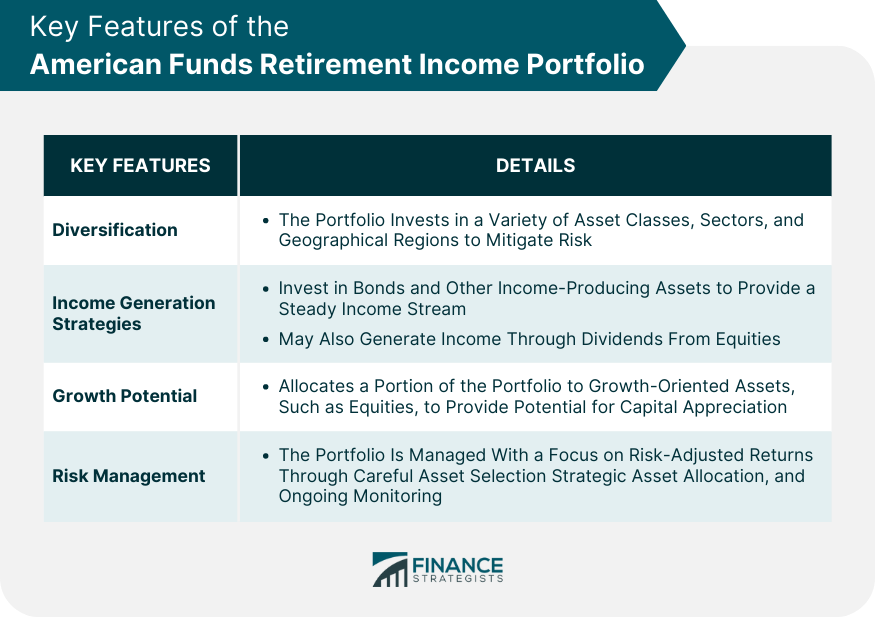

American Funds Retirement Portfolio Features, Costs

American Funds Portfolio Series Capital Group

For Example You May Have Seen American Funds Growth Fund Of America Or American Funds Fundamental Investors Or American Funds Small Cap World In Either R1, R2,.

The Portfolios Spread Risk Over Multiple, Diverse Types And Classes Of Mutual Funds.

An Oversight Committee Meets Regularly To.

Each Underlying American Funds Fund Is Managed By A Group Of Portfolio Managers.

Related Post: